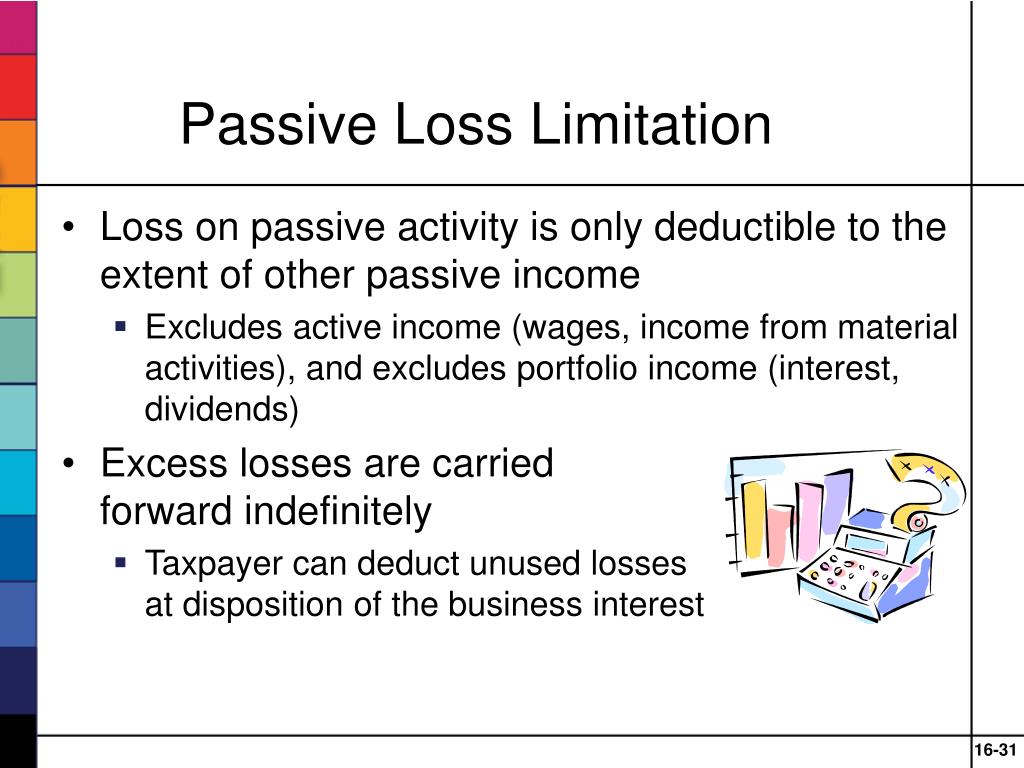

Passive Loss Income Limitations . Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. However, there is a special allowance under. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income.

from www.slideserve.com

Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. However, there is a special allowance under. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year.

PPT Chapter 16 PowerPoint Presentation, free download ID4222867

Passive Loss Income Limitations However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, there is a special allowance under. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how.

From www.youtube.com

How to Complete IRS Form 8582 Passive Activity Loss Limitations YouTube Passive Loss Income Limitations You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. Information about form 8582, passive activity loss limitations, including recent updates, related forms and. Passive Loss Income Limitations.

From slideplayer.com

Losses Deductions and Limitations ppt download Passive Loss Income Limitations However, there is a special allowance under. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. Under the passive activity rules you can deduct up to $25,000 in passive. Passive Loss Income Limitations.

From www.slideserve.com

PPT Passive Activity Loss Limitations PowerPoint Presentation, free Passive Loss Income Limitations However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Under the passive activity rules you can deduct up to $25,000 in passive. Passive Loss Income Limitations.

From gavtax.com

Demystifying Passive Activity Loss Rules in Taxation Passive Loss Income Limitations Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, there is a special allowance under. If a taxpayer does not have passive income from rental real estate or. Passive Loss Income Limitations.

From www.slideserve.com

PPT Chapter 3 Business & Expenses Part I PowerPoint Passive Loss Income Limitations However, there is a special allowance under. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. Information about form 8582, passive activity loss. Passive Loss Income Limitations.

From www.slideserve.com

PPT Chapter 15 PowerPoint Presentation, free download ID572798 Passive Loss Income Limitations However, there is a special allowance under. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. You can carry passive losses forward to future years and claim. Passive Loss Income Limitations.

From www.slideserve.com

PPT Chapter 3 Business & Expenses Part I PowerPoint Passive Loss Income Limitations Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. However, a. Passive Loss Income Limitations.

From zamibutt.medium.com

Active vs Passive (Which one is better for you?) by Passive Loss Income Limitations Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. However, there is a special allowance under. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them against passive income in the future. Passive Loss Income Limitations.

From www.formsbirds.com

Form 8582 Passive Activity Loss Limitations (2014) Free Download Passive Loss Income Limitations If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. However, there is a special allowance under. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them. Passive Loss Income Limitations.

From www.bettercapital.us

Comprehension Of Passive Activity Limits And Passive Losses (2021 Tax Passive Loss Income Limitations However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of. Passive Loss Income Limitations.

From www.awesomefintech.com

Passive Loss AwesomeFinTech Blog Passive Loss Income Limitations However, there is a special allowance under. Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. If a taxpayer does not have passive income from rental real estate. Passive Loss Income Limitations.

From www.slideserve.com

PPT Chapter 15 PowerPoint Presentation ID572798 Passive Loss Income Limitations However, there is a special allowance under. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them. Passive Loss Income Limitations.

From www.youtube.com

LLCs with Passive Investors Active vs. Passive Loss Limitations YouTube Passive Loss Income Limitations If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them against passive income in the future if. Passive Loss Income Limitations.

From www.stessa.com

Understanding Passive Activity Limits and Passive Losses [2021 Tax Passive Loss Income Limitations If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income. However, there is a special allowance under. Information about form 8582, passive activity loss limitations, including recent updates,. Passive Loss Income Limitations.

From www.slideserve.com

PPT Passive Loss Rules PowerPoint Presentation, free download ID Passive Loss Income Limitations If a taxpayer does not have passive income from rental real estate or other sources to allow the use of passive losses generated by. Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in. Passive Loss Income Limitations.

From www.debtfreedr.com

Understanding Passive Activity Loss Rules And Limitations Passive Loss Income Limitations However, there is a special allowance under. However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. Information about form 8582, passive activity loss. Passive Loss Income Limitations.

From www.awesomefintech.com

Passive Loss AwesomeFinTech Blog Passive Loss Income Limitations However, a special rule allows landlords with up to $100,000 in total income to deduct up to $25,000 in rental losses each year. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. If a taxpayer does not have passive income from rental real estate or other. Passive Loss Income Limitations.

From www.slideserve.com

PPT Chapter 11 PowerPoint Presentation, free download ID771696 Passive Loss Income Limitations Information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how. You can carry passive losses forward to future years and claim them against passive income in the future if they exceed the passive. If a taxpayer does not have passive income from rental real estate or other sources to allow the use of. Passive Loss Income Limitations.